Market feels heavy, added trades – Week 8

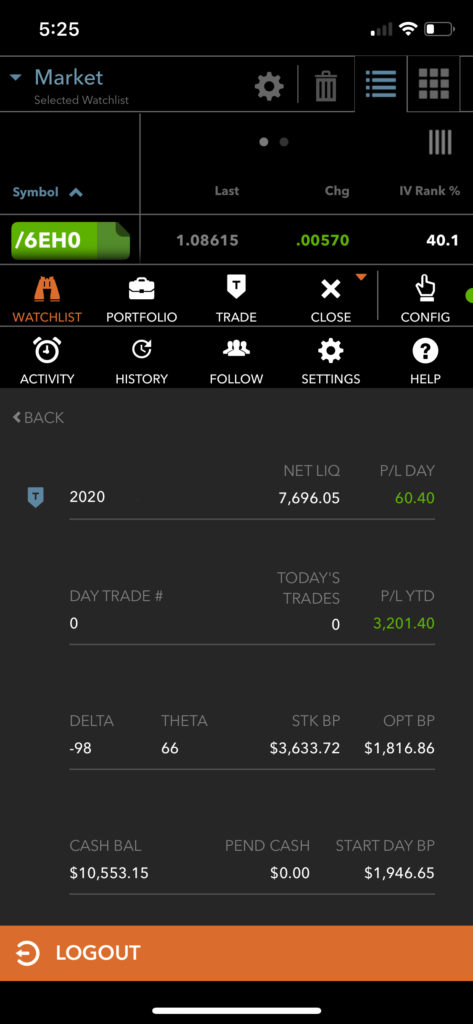

Week 8 – P/L

New trades/adjustments

| Date | 02/20 | 02/21 | 02/18 | 02/18 | 02/18 | 02/18 | 02/18 | 02/18 | 02/18 | 02/19 | 02/20 | 02/21 | 02/21 |

| Cycle | Feb/21 | Feb/21 | Mar/20 | Mar/20 | Mar/17 | Mar/26 | Mar/06 | Mar/20 | Mar/20 | Mar/26 | Feb/25 | Mar/20 | Mar/20 |

| Symbol | TSLA | TSLA | AAPL | AMZN | /CLJ0 | /NGJ0 | /6EH0 | AMD | SPCE | /GCJ0 | /NGH0 | MSFT | SMH |

| IVR | | | 43 | | 39 | 29 | 49 | 51 | 100 | 37 | 100 | 72 | |

| Strategy | IF | Cr – C | IC | Cr – C | IC | Cr – C | Cr – P | IC | Cr – C | Cr – C | IC | IC | IC |

| Strikes | p:-$850/+$845 c:-$850/+$855 | -$910/+$915 | p:-$295/+$290 c:-$340/+$345 | -$2320/+$2330 | p:-$47/+$48 c:-$57/+$58 | -$2.05/+$2.15 | -$1.08/+$1.0775 | p:-$50/+$45 c:-$65/+$70 | -$45/+$50 | -$1665/+$1675 | p:-$1.85/+$1.75 c:-$1.9/+2.0 | p:-$160/+$155 c:-$195/+$200 | p:-$135/+$130 c:-$157/+$162 |

| Price | $4.53 | $0.43 | $1.16 | $1.28 | $.26 | $.24 | $.0009 | $1.00 | $.72 | $1.3 | $.54 | $.74 | $1.09 |

| PoP | | | 64% | | 68% | 70% | 61% | 67% | 70% | 80% | 74% | %68 |

Closed trades

| Cycle | Feb/21 | Feb/21 | Feb/21 | Mar/20 |

| Symbol | TSLA | TSLA | TSLA | AAPL |

| Total open price | $2.85 | $4.53 | $.43 | $1.03 |

| Close price | $5.01 | $4.91 | $0 | $.54 |

| Multiplier | 100 | 100 | 100 | 100 |

| P/L | -$216 | -$38 | $43 | $49 |

Daily Scalp

| Date | 02/19/20 | 02/21 |

| Symbol | NDX | SPX |

| Strategy | Cr – C | Cr – P |

| Strikes | -$9750/+9760 | -$3320/+3315 |

| Price(o/c) | $118/$0 | $55/$0 |

| P/L | $118 | $55 |

| Trigger | NDX had a big gap up early during the day | SPX had a big drop early during the day |

P/L Change

- P/L Week: $11

- P/L Year: +$3807(76.14%), including rolls

- Total commission & fees: $505.08

- P/L Year w/fees: $3558.06(66.04%)