Premium selling

I primarily sell OTM options, and since my account is small, I only sell naked strangles for low price underlying(<$30), for bigger stocks I sold Iron Condors with $5 width spreads.

For Iron Condors I stick to the Tastytrade rules which shows $5 width is a good balance between risk and reward.

Most of the time I go delta neutral, but sometimes I have direction bias.

High liquidity, high IV

Liquidity is king. Since my account is small, I really hunt for the most liquid underlying.

As of high IV rank, it’s really hard to come by nowadays at the beginning of 2020. An IV rank of >30 for ETFs, and >40 for stocks are good options.

Product-agnostic – sort of

Technically with high IV and liquidity as the main indicators, I should be okay with product-agnostic. However I do find it more enjoyable when I trade the products that I’m familiar with, which are tech stocks, energy, precious metals, retails and sometimes currencies.

What about earnings?

I used to trade earnings a lot, especially in the low IV environment. However I couldn’t get consistent performance, and it’s even harder to defend than daily scalps. So I’ve made a new rule: only trade earnings for the longer dated cycles. Always use defined risks. (I did have some limited success with BWB)

Management

- Close winning trades: hitting 50% max possible profit, or at 21 days before expiration.

- Losing trades: roll up/down the untested sides to collect more premium, do not invert unless really necessary.

- Take defined risk losing trades to expiration day.

- Undefined losing trades: close when loss is 2X premium collected.

- Do not roll except for core positions. Always prefer opening new trades on the same symbols(with new assumptions).

Daily Scalp

I trade index options(SPX, NDX, RUT etc) on the same day of expiration. I know this is crazy and basically a fancy way of gamble. I’ve had good and bad days and especially bad days in the past. However I’ve used to this and think I’m getting better with the following rules.

- Do not trade within the 1st hour after market opens.

- Always scalp from the opposite side of market directions and only consider trading when the move is significant(>0.8% in the current environment).

- Size matters: prefer $5 width, but $10 width is manageable. 10% return on capital is acceptable.

- It’s not always a good idea to leg in and make an Iron Condor! Be prepared for the market back and forth.

- Control your emotions and fight on! This is the most difficult part and bad days are bound to happen. Normally for a $10 width spreads, it’s possible to control the damage with inversions and keep the loss <$5.

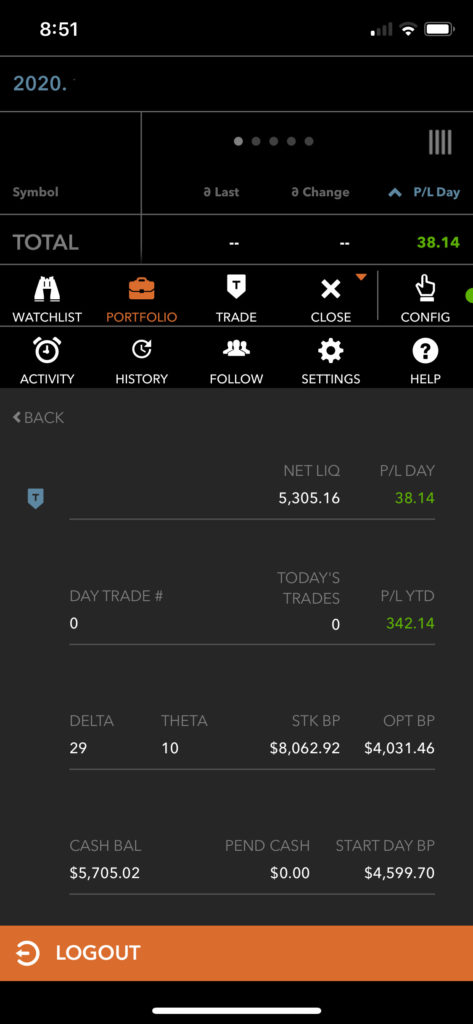

- Always keep powers try for daily scalp! In my experience for successful scalp w/management, I need $2k available buying power.

- Watch for PDT rules: If all goes well, I open trades and let them expire worthless, but sometimes I did need to close/roll within same day, so be smart and do not let same day trade counter goes beyond 3!